BTC Price Prediction: $115K Target Amid Institutional Accumulation and Oversold Signals

#BTC

BTC Price Prediction

BTC Technical Analysis: November 2025 Outlook

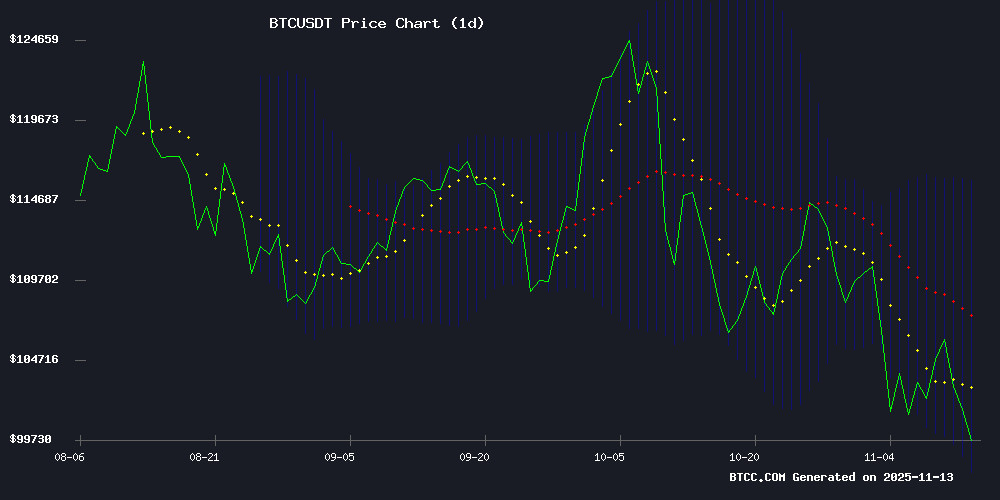

According to BTCC financial analyst Michael, Bitcoin (BTC) is currently trading at, below its 20-day moving average (MA) of 106,958.03. The MACD indicator shows a bullish crossover with a positive histogram (1,001.95), suggesting potential upward momentum. However, BTC remains near the lower Bollinger Band (98,263.04), indicating oversold conditions. A breakout above the middle band (106,958.03) could signal a rally toward the upper band at 115,653.02.

Market Sentiment: Mixed Signals Amid Regulatory and Institutional Activity

Michael notes conflicting narratives in recent news: Musk's XChat privacy features draw bitcoin comparisons, while profit-taking and Morgan Stanley's caution hint at short-term volatility. Institutional accumulation ($104K breakout potential) and McDonald's Bitcoin rally speculation contrast with warnings about Taproot addresses and quantum computing risks. China's $13B BTC theft accusation adds geopolitical tension.

Factors Influencing BTC’s Price

What Is XChat, Musk’s New Social App With Bitcoin-Like Privacy?

Elon Musk is set to launch XChat, a new messaging app positioned as a rival to WhatsApp and Telegram. The platform will feature peer-to-peer encryption modeled after Bitcoin's architecture, though experts question whether this represents genuine innovation or mere branding.

Musk revealed details during an interview with Joe Rogan, emphasizing XChat's ad-free model and end-to-end encryption for texts, files, and calls. The app will integrate with X (formerly Twitter) while offering standalone functionality, with a planned release within months.

The Bitcoin comparison appears primarily metaphorical—while both systems use peer-to-peer networks, XChat's implementation remains undefined. This contrasts with established privacy tools like Signal that employ verifiable cryptographic standards rather than cryptocurrency-inspired terminology.

Bitcoin Faces Critical Support Test as Gold Advocate Schiff Issues Warning

Bitcoin's hold above $100,000 appears increasingly fragile as veteran Gold proponent Peter Schiff renews his criticism of the cryptocurrency. Schiff warns the window to sell above this psychological level is closing rapidly, predicting a potential market implosion if support fails. His remarks coincide with Bitcoin's 10% monthly decline and gold's rally to three-week highs.

The flagship cryptocurrency now trades at $101,992 after failing to sustain momentum above $105,000. Technical factors compound the pressure: $939 million has exited spot BTC ETFs, whales are executing large transfers, and macroeconomic uncertainty persists around delayed U.S. economic data. Meanwhile, gold's 5% weekly gain to $4,180/oz fuels the perennial debate between digital asset proponents and precious metal advocates.

China Accuses the US of Stealing $13 Billion in Bitcoin (BTC)

China's National Computer Virus Emergency Response Center (CVERC) alleges the U.S. government orchestrated a cyberattack in December 2020, resulting in the theft of 127,000 BTC worth $13 billion. The stolen assets reportedly belonged to Vincent Chen Zhi, a Chinese-Cambodian tycoon linked to mining firm LuBian and Prince Group.

The accusations surface amid heightened U.S.-China tensions, with trade wars and tariffs dominating bilateral discussions. The U.S. Justice Department had previously seized the bitcoin cache in October, claiming ties to human trafficking and fraud operations—a charge Zhi dismisses as baseless.

Japan Considers Stricter Regulations for Crypto Treasury Firms Amid Market Volatility

Japanese regulators are tightening scrutiny on listed companies holding digital assets as crypto market turbulence exposes investor risks. The Tokyo Stock Exchange operator is evaluating stricter backdoor listing rules and mandatory audits for firms with cryptocurrency exposure, according to sources familiar with the matter.

At least three Japan Exchange Group-listed companies have suspended crypto acquisition plans since September following warnings about potential fundraising limitations. While no blanket prohibition exists, the exchange now actively monitors corporate crypto holdings through risk and governance lenses to protect shareholders.

The regulatory rethink follows dramatic declines in crypto treasury stocks modeled after MicroStrategy's BTC accumulation strategy. Such positions have surrendered earlier gains, leaving retail investors facing significant losses as market conditions deteriorate.

Profit-Taking Hits Bitcoin as Market Enters ‘Fall Season’, Morgan Stanley Flags Short-Term Caution

Morgan Stanley has advised Bitcoin investors to take profits as the cryptocurrency enters what analysts describe as its "fall season." Denny Galindo, an investment strategist at Morgan Stanley Wealth Management, notes Bitcoin's four-year cycle pattern—three years of gains followed by a year of losses. "We are in the fall season right now," Galindo said on the Crypto Goes Mainstream podcast. "Fall is the time for harvest. So, it’s the time you want to take your gains."

Bitcoin dropped below $99,000 on November 5, breaching its 365-day moving average—a technical bear market signal. The decline reflects broader pressure on risk assets, driven by profit-taking and cooling enthusiasm in AI and tech stocks. Liquidity conditions have weakened, with market-maker Wintermute citing reduced support from stablecoins, ETFs, and digital asset treasuries.

Immediate support for Bitcoin lies between $100,000 and $102,000, while resistance hovers NEAR $110,000. The market’s seasonal shift underscores the need for tactical positioning amid fluctuating sentiment.

Bitcoin Price Prediction: $104K Breakout Looms Amid Institutional Accumulation

Bitcoin hovers near $102,100 as markets digest conflicting signals. Corporate treasuries continue accumulating BTC despite October's slowdown, with MicroStrategy maintaining dominance despite its share dropping to 60% of corporate holdings. Morgan Stanley warns of profit-taking risks while technical patterns suggest a potential breakout toward $104,000.

MicroStrategy's 640,808 BTC treasury remains industry-leading but increasingly contested. Japan's Metaplanet emerged as October's most aggressive accumulator with 5,268 BTC, while Coinbase added 2,772 BTC. The corporate buying pace has cooled to 2025's lowest monthly level at 14,447 BTC.

Fidelity Digital Assets observes sustained institutional interest even as the stronger dollar creates headwinds. The symmetrical triangle formation on BTC charts keeps traders anticipating upward resolution, contrasting with Wall Street's cautious stance during this consolidation phase.

Adam Beck’s Bitcoin Realization: What Kind Of Money Is BTC?

Bitcoin (BTC) continues to redefine its role in the financial ecosystem, with Adam Back, Blockstream CEO, asserting its identity as permissionless bearer money. This vision aligns with the cypherpunk ethos of self-sovereignty and decentralization, where ownership is verifiable without intermediaries.

The Lightning Network, a LAYER 2 solution developed by Blockstream, aims to enhance BTC's transactional efficiency. Yet, critics highlight its permissioned nature, sparking debate over whether it compromises Bitcoin's foundational principles. The tension between scalability and decentralization remains unresolved.

McDonald's McRib Return Sparks Bitcoin Rally Speculation

The return of McDonald's McRib sandwich has unexpectedly become a talking point in cryptocurrency circles, with traders drawing parallels to past Bitcoin price surges. Bitcoin Archive, a popular social media account, highlighted a historical pattern where McRib comebacks coincided with significant BTC rallies—noting gains of 1,000% in 2017 and 200% in 2020 following the sandwich's reintroduction.

Bitcoin currently trades near $104,400, struggling to breach the $110,000 resistance level. Market observers are now watching whether the 2024 McRib return—launched November 11—will precede another all-time high, as suggested by the whimsical correlation.

Bitcoin Volatility Sparks Rotation into DeFi Token RentStac

Bitcoin's price swings above and below $100,000 have analysts eyeing the next market rotation. Historical patterns suggest capital typically flows into emerging projects during such volatility. RentStac, a DeFi token with Bitcoin-like scarcity mechanics, is gaining attention as a potential beneficiary.

The token mirrors Bitcoin's fixed-supply model but adds real-world asset backing through rental income streams. This hybrid approach offers measurable fundamentals alongside crypto-native features—a combination attracting investors seeking stability in turbulent markets.

Market observers note parallels between Bitcoin's early adoption curve and RentStac's growth trajectory. Both employ transparent, decentralized systems, though RentStac's value derives partially from verifiable property income rather than pure speculation. The project's deflationary tokenomics, including a capped supply and burning mechanism, further echo Bitcoin's halving-driven scarcity model.

Expert Warns Bitcoin Holders to Avoid Taproot Addresses Amid Quantum Computing Threat

On-chain analyst Willy WOO has sparked a technical debate with his "DUMMIES GUIDE TO BEING QUANTUM SAFE," urging Bitcoin holders to migrate coins away from Taproot addresses (bc1p) to older SegWit bc1q or P2PKH/P2SH formats. The warning centers on quantum computing's potential to derive private keys from exposed public keys—a vulnerability inherent in Taproot's design.

"In the age of big scary quantum computers, you need to protect your public key," Woo asserted. Unlike legacy formats that conceal public keys until transaction time, Taproot embeds them directly in addresses. The advisory comes as researchers globally race to develop post-quantum cryptography standards.

Bitcoin Dominates Russian Investment Returns Despite Recent Volatility

Russia's central bank has formally recognized Bitcoin's investment supremacy in its latest Financial Market Risks Overview. The cryptocurrency delivered 154.2% returns since 2022 and 29.4% over the past year, outperforming traditional assets.

October's market correction pushed Bitcoin's 2024 returns into negative territory (-6.6%), with projections showing -7.2% for 2025. Gold emerged as October's top performer (+3.5%), while corporate bonds lead year-to-date returns.

The Bank of Russia continues monitoring Bitcoin despite its cautious stance on cryptocurrencies. The digital asset now features regularly in the regulator's market analyses, reflecting its growing institutional relevance.

How High Will BTC Price Go?

Michael projects two scenarios based on current data:

| Scenario | Price Target | Conditions |

|---|---|---|

| Bullish | 115,653 USDT | Break above 20-day MA with MACD confirmation |

| Neutral | 104,000 USDT | Institutional support holds |

Key resistance levels to watch: 104K (psychological), 106,958 (20MA), 115,653 (Bollinger upper). Support at 98,263.

- Oversold bounce potential: BTC nears lower Bollinger Band with bullish MACD divergence

- Institutional accumulation: On-chain data suggests whales are buying below $104K

- Event catalysts: XChat launch and McRib promotion could drive retail interest